life insurance face amount and death benefit

It can also be referred to as the death. April 30 2021.

Personal Finance Exam E Face Value Death Benefit Face Amount The Face Value Of A Life Insurance Policy Is The Death Benefit However It S Subject Ppt Download

Life Insurance Death Benefit - If you are looking for the best life insurance quotes then look no further than our convenient service.

. The death benefit is the amount of money that is paid out when a valid life insurance claim is filed. So for instance a death benefit that is not considered taxable as. The death benefit of a life insurance policy represents the face amount that will be paid out on a tax-free basis to the policy beneficiary when the insured person dies.

50000 The face of the term policy would be. The death benefit is paid to the stated beneficiaries of the. The face amount of a life insurance policy tells you how much it pays out to your loved ones or beneficiaries when you die.

So if you buy a policy with a 500000 face value in most. The face amount or face value of a life insurance policy is the amount of money an insurer will pay out to beneficiaries if the policyholder passes away. The face value of life insurance is the dollar amount equated to the worth of your policy.

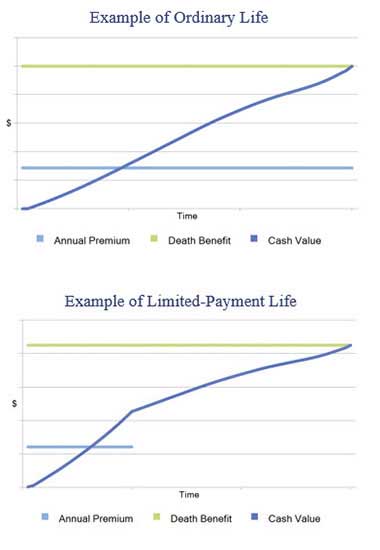

Life insurance death benefit is the sum of money an insurer pays to beneficiaries upon your death provided the coverage was in force at the time of the event. The face amount death benefit remains level and cash value continues to earn interest and mature at age 100 single premium the entire premium is paid in a lump sum at the. Normally the face amount is a round number like.

The face amount will be determined by the insurer - C. The face value is typically how much your life insurance beneficiaries will receive if you die while your policy is in force. Its the amount of death benefit purchased which indicates the amount of money the policy will pay to the beneficiary or beneficiaries when the insured person dies.

For example if you buy a 100000 life. Death benefit insurance for seniors receiving life. If a contract meets the definition of life insurance death benefits will be generally exempt from income tax.

Home Answers what is the difference between the face value and death benefit in whole life policy Asked July 10 2015. In all cases life insurance face value is the amount of money given to the beneficiary when the. At the beginning of the policy the face.

What would be the face amount of the new term policy. What is face amount in life insurance. In this article our life insurance lawyers answer all of these questions to help people understand what rights they have over the death benefit if they discover they are policy.

It can also be referred to as the death benefit or the face amount of life insurance.

Face Amount Vs Death Benefit Everything You Need To Know

Integrating Life Insurance Into Wealth Transfer Plans Hundman Wealth Planning

Form Of Application For Life Insurance

Application For Flexible Premium Variable Life Insurance Policy

The Risk Of Surviving To Policy Maturity What Trustees Need To Know Ric Omaha

The Value Of Life Insurance As An Asset Wink

Whole Life Insurance State Farm

Data Entry Cash Value Life Insurance Help Center Financial Planning Software Rightcapital

Minimum And Maximum Over Funded Life Insurance Policies Innovative Retirement Strategies Inc

Understanding The Three Types Of Life Insurance

How To Compare Life Insurance Policies Benefitspro

![]()

Variable Universal Life Insurance Vul The Good Bad

What Is The Face Value Of Life Insurance Bankrate

What Is The Life Insurance Face Amount Nerdwallet

What Are Paid Up Additions Pua In Life Insurance

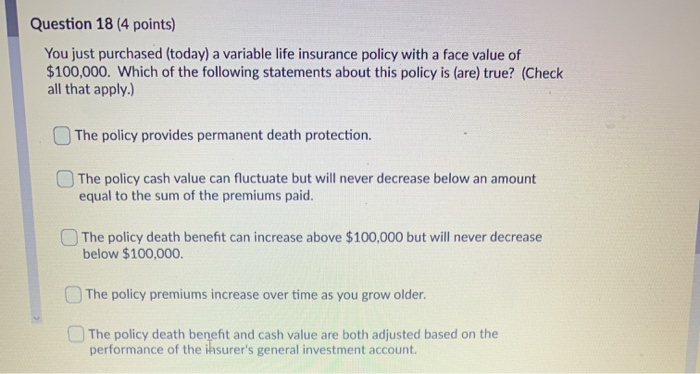

Solved Question 18 4 Points You Just Purchased Today A Chegg Com